Continued technology adoption will be critical to remain competitive in the food industry

Continued technology adoption will be critical to remain competitive in the food industry

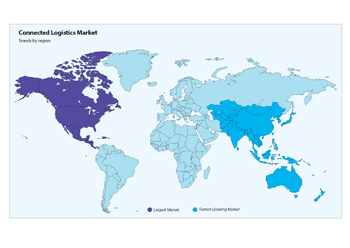

The global food and grocery retail market will reach $14.6 trillion by 2026; online grocery revenues will surpass $1 trillion by 2026. But empty shelves, growing food prices, and labour shortages in recent years have highlighted the fragility of global supply chains. Suppliers, distributors, and retailers are turning to digital transformations to cater to a rapidly growing market for end-to-end visibility and operational efficiency.

According to global technology intelligence firm ABI Research, Warehouse Management Software (WMS) revenue in the food and beverage (F&B) industry will reach $975.2 million globally by 2026. Continued technology adoption will be critical to remain competitive and fulfill growing consumer demand for omnichannel offerings.

“Technology adoption in the food industry has notoriously been low compared to other industries due to the razor-thin margins on food products and the challenge in managing products of different shelf lives and condition requirements. However, it is these very challenges that wide-scale digital transformations can help overcome, as well as help to ensure long-term price competitiveness and consistency in product availability. Accessible and scalable solutions are necessary for companies at each stage of the supply chain to thrive in such a fast-paced market,” explained Ryan Wiggin, Supply Chain Management & Logistics Industry Analyst at ABI Research.

As the volume of food and the number of ways consumers can shop for their groceries increases and the amount of labour available decreases, retailers are turning to software and hardware solutions to alleviate operational constraints. Enabled traceability via the Internet of Things (IoT) data-fueled software solutions, such as WMS and Supply Chain Control Towers, are becoming increasingly sophisticated and more accessible.

As such, companies can move away from manual tracking and support better operational decision-making with deeper visibility and forecasting. Companies like the Optel Group deliver centralised platforms to harmonise data and stakeholders across the supply chain, allowing companies to manage and react better to events. At the same time, companies like Wiliot offer innovative IoT solutions that can track product location, temperature, and exposure to provide real-time granular data and ensure food safety.

From a hardware angle, handheld devices, mobile computers, and interactive kiosks from companies like Zebra are facilitating retailers’ move into omnichannel offerings to significantly increase worker productivity at both a store and warehouse level. And item picking solutions from robotics firms, such as RightHand Robotics, are helping to automate end-of-line operations to support micro-fulfillment and online order picking. Broader deployments of Autonomous Mobile Robots (AMRs) and Automated Storage & Retrieval Systems (AS/RS) in warehouses continue to grow as functionality and control over the scale of deployments for end users develop.

“Growing operational pressures and incoming regulation such as FSMA Rule 204 will drive investment, but collaborative strategies and upskilling will be necessary to smooth adoption. Food companies must identify current pain points and establish phased digital transformation plans. Technology vendors need to facilitate step approaches to adoption with continued engagement to ensure technology dispersal in the food industry is equitable and widespread,” concluded Wiggin.