EGA agreed to supply solar aluminium to Kobe Steel to make automotive body sheet for Nissan

EGA agreed to supply solar aluminium to Kobe Steel to make automotive body sheet for Nissan

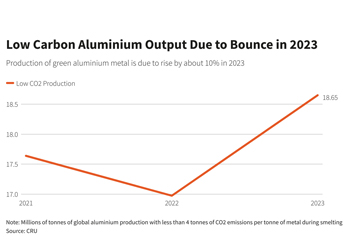

Aluminium makers are set to boost low-carbon metal output by 10 per cent in 2023 and churn out even more in the years ahead, driving down the cost for carmakers seeking climate-friendly supplies and shrinking the industry’s hefty carbon footprint, according to a Reuters analysis.

Aluminium is the most energy-intensive metal to produce, accounting for about 1.1 billion tonnes of global CO2 emissions per year. Next year’s forecast increase in “green aluminium” output would reduce that by 13 million tonnes, or about 1.2 per cent.

Pressure by governments to cut greenhouse gas emissions has given aluminium producers an incentive to ramp up output of the low-carbon material, which emits less than 4 tonnes of CO2 per tonne of metal compared to the global average of 16.6 tonnes.

That means global surpluses of green aluminium – largely produced using hydro power or recycled material - already weigh on the premium that producers can charge buyers, from automakers and beverage can firms to construction suppliers.

“It’s (the premium) been very modest now for the last couple of years,” Ivan Vella, chief executive of Rio Tinto Aluminium, told an investor conference last month.

Vella added that the company had seen some increases in premiums recently, without giving details.

GREEN PRODUCTS

-copy.jpg) |

|

|

Global supplies of low-carbon aluminium have been robust for several years, but dipped in 2022 mainly due to restrictions in southern provinces in top producer China that rely on hydro power.

Output is due to bounce back globally next year, rising 10 per cent to 18.56 million tonnes – accounting for 26 per cent of total aluminium production, said Simon Large, analyst at consultancy CRU.

In Europe, the proportion of low-carbon products to overall supply is much higher than in the rest of the world, because large Scandinavian producers typically use hydro power, and should reach 83 per cent next year, he added.

AUTO INDUSTRY

The increase in more sustainable supplies has coincided with growing efforts by companies to demonstrate their green credentials to consumers, led by the European car sector.

Germany’s BMW agreed last year to buy aluminium made with solar power from Emirates Global Aluminium (EGA), while Volkswagen’s premium brand Audi is piloting metal from the new ELYSIS technology pioneered by Alcoa and Rio Tinto, which eliminates all CO2 emissions and replaces them with oxygen.

Most companies are reluctant to disclose how much low-carbon material they buy and any premiums paid for competitive reasons.

Electric vehicle (EV) maker Polestar has started to use green aluminium as part of a project to create a vehicle with zero emissions from every aspect of production, teaming up with Norway’s Norsk Hydro, which uses hydro power to produce much of its metal.

Polestar said it pays slightly more for green aluminium, partly due to the administrative costs of changing suppliers, but did not say how much more.

“The cost per reduced kg of CO2 emissions when shifting to green aluminium is still significantly lower than many other ways of reducing raw material emissions,” a company spokesperson told Reuters.

Norsk Hydro also inked a deal to supply Mercedes-Benz with aluminium that produces less than 3 tonnes of CO2 emissions per tonne of metal.

HEAVY INVESTMENT

|

Aluminium companies have invested heavily in low-carbon technologies. Norsk Hydro said this year it had spent billions making its aluminium more sustainable, while Rio Tinto, Alcoa and the Canadian government invested $228 million in their new ELYSIS process.

But such investments to step up output are dampening the prices that producers can charge for their low-carbon products, especially this year when overall demand has been hit by recession fears, analysts say.

“Low carbon premiums on the spot side have basically disappeared,” said Jorge Vazquez at consultancy Harbor Aluminum. The spot premium for low-carbon billet, a fabricated product often used in construction, has slid to zero from $30 a tonne in January, he said.

Producers, however, are still managing to sell some of their low-carbon output at higher prices under quarterly and annual contracts. Wire rod commands the highest premiums due to its use in power wiring linked to the green energy transition around the world, he added.

But even the bumper premium for wire rod of $45 a tonne represents less than 2 per cent of the underlying benchmark aluminium price.

REGIONAL VARIATIONS

“Where we’ve seen the most willingness to entertain green premiums is Europe, where it is quite accelerated, and we’re starting to see the early elements in North America, but Asia is behind,” said an industry source who declined to be identified.

In Europe, premiums may get a lift from European Union proposals to impose tariffs on imports of high-carbon goods by 2026, another analyst said.

Consumers are benefitting from the plentiful supplies of not only low-carbon primary aluminium, but recycled material, which uses about 95 per cent less energy to make.

Rising output of both will keep green premiums relatively low in the coming years, said Marcelo Azevedo at the McKinsey consultancy. Limited movement of supplies between regions, however, could lead to deficits in high-demand areas such as Europe, he added.

One area bucking the weak trend is “ultra-low” carbon aluminium, meaning metal produced with less than 2 tonnes of carbon emissions per tonne of metals, where premiums are strong due to lack of material, Azevedo said.

ALUMINIUM COMPANIES COMPETE TO SELL LOW-CARBON PRODUCTS

Aluminium companies have launched a raft of aluminium products with lower carbon emissions, largely by either using hydro power or recycled material.

Primary aluminium emits on average 16.6 tonnes of CO2 per tonne of metal, according to the International Aluminium Institute (IAI), based on 2021 data, making it one of the most carbon-intensive segments of the metals industry.

Below are low-carbon aluminium brands by the major producers.

Producer: ALCOA

Brands:

ECOLUM – Primary aluminium with a total carbon footprint of under 4 tonnes of CO2, including bauxite mining and refining.

ECODURA – Aluminium billet made with minimum of 50 per cent recycled content.

Producer: NORSK HYDRO

Brands:

REDUXA – Two products of primary aluminium, one with carbon content below 4 tonnes of CO2 per tonne of metal and the second below 3 tonnes. This includes emissions from bauxite mining and making products such as alloyed metal.

CIRCAL – Two products of recycled metal, one with a minimum of 75 per cent used aluminium and a footprint of less than 2.3 tonnes of CO2, and the other from 100 per cent recycled metal with less than 0.5 tonnes of CO2.

Producer: RIO TINTO

Brand:

RENEWAL – Primary metal with CO2 emissions of 4 tonnes or less of CO2 per tonne of metal.

Producer: RUSAL

Brand:

ALLOW – Primary metal with a footprint of less than 4 tonnes of CO2, based on direct and indirect smelter emissions only, by using hydropower in Siberia.

Producer: EMIRATES GLOBAL ALUMINIUM

Brand:

CELESTIAL – EGA markets a brand of primary metal produced with solar power. It produced 39,000 tonnes of solar-powered metal last year, making up 1.5 per cent of total output.

Producer: CENTURY ALUMINUM

Brand:

NATUR-AL – Century markets a low-carbon product with less than 4 tonnes of CO2 made at its plant in Iceland.

Producer: CHINA HONGQIAO GROUP

The Chinese producer has introduced two low-carbon products, HQALoop and HQALight, one made with recycled aluminium and the other from low-carbon aluminium produced in Yunnan using hydro electricity and other renewables.

Producer: ALCOA/RIO TINTO JOINT VENTURE

Brand:

ELYSIS – Joint venture between the two groups to commercialise a new technology by 2024 to produce carbon-free aluminium, using a ceramic anode and emitting only oxygen.