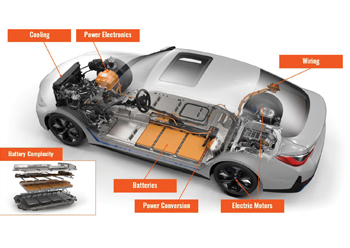

New components and added complexity for electric vehicles

New components and added complexity for electric vehicles

Few would argue that the automotive industry can be complex. Everything from model design to after-sales services requires a large sum of resources and pinpoint accuracy.

From facing extreme downtime costs, significant product development costs, and rapidly shifting consumer sentiment, the supply chain for automotive is equally complicated, with tiers of global suppliers each integral to an original equipment manufacturer’s (OEM) operation. If a parts supplier experiences unexpected downtime, the impact is felt through the rest of the value chain up to the OEM.

ENTER AUGMENTED REALITY

However, in the quest to keep downtime to a minimum and streamline operations through the entire value chain, Augmented Reality (AR) can do both, says ABI Research in a whitepaper.

“Augmented Reality (AR) and Mixed Reality (MR) can enhance nearly every facet of automotive operations because it allows workers to go hands-free and most carmakers already have existing platforms that can take advantage of AR,” reveal the findings from ABI Research’s Automotive Sector Complexities and the Role of Augmented Reality whitepaper.

As automotive AR has shifted from the “education phase” to a more mature market, ABI Research expects automotive smart glasses shipments to approach the 2 million mark by 2027.

Reduced error rates and increased safety for workers are matched with reduced operational downtime, reduced travel time and costs, and, ultimately, increased operational efficiency.

Companies in the automotive industry have a few options when it comes to immersive technologies. The three main device categories are:

Assisted Reality (AR) Smart Glasses: These devices are typically monocular (single display) Head-Mounted Displays (HMDs). The focus for assisted reality devices is on quick access to information and optimal user vision. Two-Dimensional (2D) content display and onboard cameras (for data capture) add further value.

Mixed Reality (MR) Devices: These types of AR devices are Binocular (dual display) HMDs that can provide Three-Dimensional (3D) spatial tracking. Microsoft’s HoloLens 2 is the start product in the MR domain. Because MR devices provide greater environmental awareness and immersion than assisted reality, they are also more expensive and complex to implement and maintain. But the good news is there are low-code and no-code platforms that automotive players can leverage for better ease of use.

Mobile Devices: Although not nearly as robust as assisted reality and MR devices, mobile devices do provide convenience at a low-cost entry point. For that reason, AR-enabled mobile devices are an attractive option for resource-lacking automotive players. Unfortunately, mobile devices lack hands-free and 3D experiences that are game-changers in the AR space.

AR AND MR USE CASES

Because AR and MR smart glasses provide hands-free access to data, workers are equipped with the information they need without t taking any extra steps. Not only does this bolster workplace safety, but it also creates immersive 3D visualisations that result in a greater likelihood of content recall. Of course, the latter is especially useful for training purposes.

Smart glasses with AR and MR capabilities enable automotive workers to assemble vehicles with step-by-step instructions and track Key Performance Indicators (KPIs). Imagine a manufacturing plant where individual employees can complete their tasks and receive operation updates without any co-workers having to take the time to do so. It goes without saying that these capabilities pave the way for a much higher level of operational efficiency, while cutting down on downtime.

AR is also used for remote assistance, where a technician can diagnose a problem and provide guidance remotely. Remote assistance is a huge cost saver, as it eliminates the need for travel. On a related note, AR visually-guided assistance to frontline workers also enhances employee skills, which inevitably reduces error rates.

AI WILL BE KEY

We already see Artificial Intelligence (AI) being deployed in virtually every business category, so it’s not surprising that AI will be critical in automotive AR use cases as well. In addition to data processing and analytics, AI can provide automation and prediction with AR content. For example, an expert technician may provide remote assistance to an end customer, then that session can be recorded and uploaded to a training video database. From there, AI can recommend the most suitable training modules for customers, negating the reliance on a live session.

Machine vision, which is a feature of AI, can be used for enhanced automotive workflows because this technology can tag physical objects that a worker sees when wearing an AR device. So, an assembly worker may see a part or component in his or her physical environment, and there will be digital content locked to it—providing instructions, best practices, etc. Another way to look at is, think of an AR machine vision model as an automated workflow.

ACTIONS TO TAKE

Before adopting AR devices for automotive operations, it’s important to identify the specific operational areas that could benefit the greatest from deployment. To decide how implementation ought to be carried out, existing platform managers and departments, such as Information Technology (IT), will need to come together and brainstorm. Such collaboration will help see where technological symbiosis lies and which hardware investments are required.