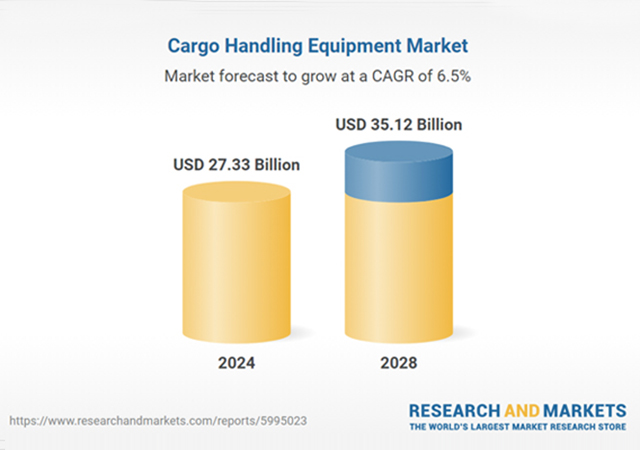

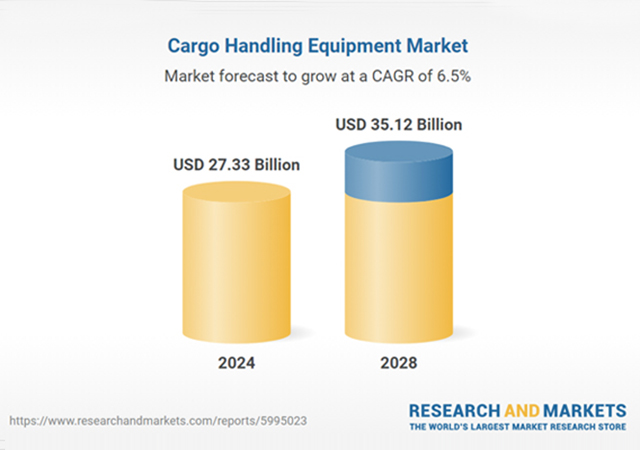

The global cargo handling equipment market has experienced robust growth in recent years. According to a report by ResearchAndMarkets, the market size is projected to increase from $25.7 billion in 2023 to $27.33 billion in 2024, reflecting a compound annual growth rate (CAGR) of 6.3 per cent.

This growth can be attributed to several factors, including rising industrialisation, the adoption of eco-friendly equipment, stringent safety and environmental regulations, advancements in air freight handling technologies, and the expansion of global shipping routes and ports.

FUTURE PROJECTIONS

Looking ahead, the cargo handling equipment market is expected to continue its upward trajectory, reaching $35.12 billion by 2028, with a CAGR of 6.5 per cent.

Key drivers during this forecast period include the shift towards electric cargo handling vehicles, increasing demand for sustainable equipment, evolving consumer preferences, the need for enhanced cargo screening and security, and a focus on reducing operational costs.

Notable trends anticipated during this time include the integration of RFID technology, advancements in 3D printing, improved hydraulic systems, AI implementation, and the use of blockchain technology.

MARKET DYNAMICS

The expected growth in the cargo handling equipment market will be fueled by rising import and export activities, bolstered by global trade dynamics.

Major companies in this sector are focusing on introducing advanced forklift models designed to enhance efficiency, incorporate automation features, and address sustainability concerns through electric and hybrid technologies.

For instance, in May 2023, Toyota Material Handling unveiled three new electric forklift models: the Side-Entry End Rider, ideal for cross-warehouse operations; the versatile Center Rider Stacker, which combines multiple functions; and the powerful Industrial Tow Tractor for heavy load towing.

These models boast AC drive motors for quiet operation, customisable controls for operator comfort, and optional features like cold storage conditioning and PIN code access for enhanced security.

In 2023, the Asia-Pacific region emerged as the largest market for cargo handling equipment.

STRATEGIC ACQUISITIONS

In February 2024, Taylor Group, a US-based industrial equipment manufacturer, acquired Italy’s CVS Ferrari for an undisclosed sum.

This acquisition aims to strengthen Taylor Group’s global market position by leveraging the combined strengths of both companies to enhance product innovation, service capabilities, and market reach.

CVS Ferrari is known for its high-quality mobile container handling and heavy cargo equipment, including reach stackers and high-capacity forklifts.