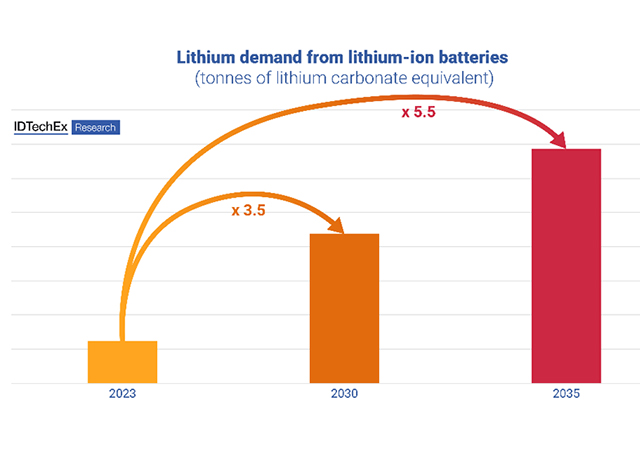

Lithium demand from lithium-ion batteries in 2023, 2030 and 2035 Source - IDTechEx

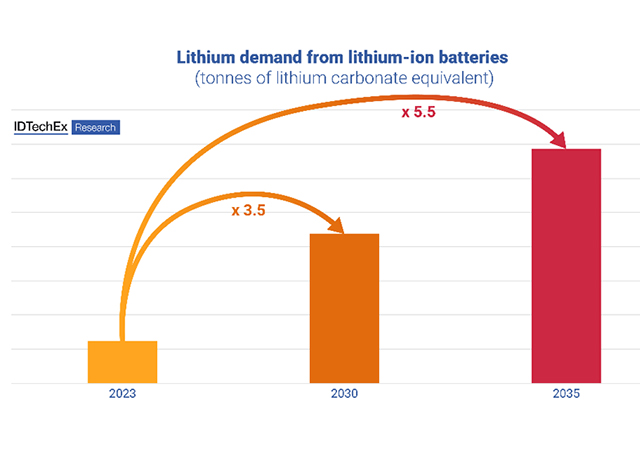

Lithium demand from lithium-ion batteries in 2023, 2030 and 2035 Source - IDTechEx

Lithium, the lightest and smallest alkali metal in the periodic table, is increasingly recognized for its significant role in modern technology, particularly in batteries. Its high electrochemical potential makes it an ideal candidate for energy storage solutions. While lithium is utilized in various applications - ranging from glass ceramics to lubricants and pharmaceuticals - its primary use lies in lithium-ion batteries.

The demand for these batteries is surging, driven by the rise of electric vehicles (EVs) and the need for efficient energy storage systems. Projections indicate that lithium demand for batteries alone will triple by 2030 and quintuple by 2035.

This explosive growth underscores the necessity for advancements in lithium mining techniques to ensure a sustainable and economically viable supply, according to Dr Jiayi Cen, Technology Analyst at IDTechEx.

THE IMPERATIVE FOR INNOVATION IN LITHIUM MINING

IDTechEx's recent report, Direct Lithium Extraction 2025-2035: Technologies, Players, Markets and Forecasts, highlights the emerging technologies in direct lithium extraction (DLE) that could revolutionize the lithium mining sector. The global lithium market is expected to grow at a compound annual growth rate (CAGR) of 9.7% from 2025 to 2035, with the DLE segment anticipated to expand at a remarkable CAGR of 19.6%. This rapid growth presents a significant opportunity to disrupt traditional brine mining practices.

UNDERSTANDING BRINE RESOURCES

Lithium can be extracted from two primary sources: hard rock minerals and brines. Despite the fact that brines comprise the majority of global lithium reserves, over 60% of current lithium production is derived from hard rock mining. In 2023, only about 37% of lithium production was sourced from brine, highlighting a considerable gap between available resources and actual extraction. The conventional brine extraction method relies heavily on evaporation ponds, a process that is not only time-consuming-typically taking 12 to 24 months-but also yields only 40-60% of the lithium present.

This traditional method is limited to areas with ideal climatic conditions and sufficient land for pond infrastructure, making it less competitive compared to hard rock mining. Consequently, brine resources remain underutilized, raising questions about the sustainability and efficiency of current extraction practices.

THE Promise of Direct Lithium Extraction

Direct lithium extraction (DLE) encompasses a range of innovative technologies designed to selectively extract lithium from brine sources. DLE addresses many of the limitations associated with traditional brine mining, offering several advantages, including faster production times-often within hours to days - and higher yields, typically ranging from 80% to 95%. By eliminating the need for evaporation ponds, DLE technology broadens the spectrum of usable brine resources, including geothermal and oilfield brines, and allows for more localized battery supply chains.

As regulations governing lithium mining evolve, such as Chile's National Lithium Strategy, there is a growing incentive for extraction technologies that minimize environmental impacts. These factors position DLE as an attractive investment opportunity, particularly in light of the increasing global demand for lithium.

CHALLENGES AHEAD FOR DLE IMPLEMENTATION

Despite its potential, DLE accounted for less than 10% of lithium production in 2023. The scaling of DLE technologies faces numerous challenges. One of the primary hurdles is that many DLE methods remain unproven, particularly in unconventional brine resources like geothermal and oilfield brines. Although there has been significant activity in the development of DLE projects, capacity growth has often fallen short of announced targets, revealing inherent uncertainties and risks.

The diverse compositions of brine and varying process conditions have led to the development of multiple DLE technologies, each with its own set of advantages and disadvantages. Given the unique nature of each brine resource, no single DLE solution can be universally applied. This variability necessitates comprehensive testing to identify the most promising investment opportunities.

EXPLORING DIFFERENT DLE TECHNOLOGIES

Several classes of DLE technologies have emerged, including adsorption, ion exchange, solvent extraction, and membrane processes. Among these, adsorption DLE is the only commercially proven technology thus far. Companies such as Sunresin and Arcadium Lithium have established DLE operations in China and Argentina, respectively. International Battery Metals and Eramet are also advancing their technologies towards commercial readiness.

Adsorption DLE utilizes aluminum-based sorbents to capture lithium, which is then released in the form of lithium salts, typically lithium chloride. This release process is known as desorption or elution, resulting in a solution referred to as eluate.

Ion exchange DLE is another promising technology, with companies like Lilac Solutions leading the charge. This method employs manganese or titanium-based sorbents to capture lithium, releasing lithium salts through a washing process involving acids. While ion exchange DLE can generate eluates with higher lithium concentrations, the need for transporting acids raises logistical challenges, and the long-term stability of ion exchange materials remains under scrutiny.

In contrast, developments in solvent extraction and membrane DLE technologies have not progressed as rapidly and remain largely in the pilot stage. Further research and development are essential to advance these methods.

ECONOMIC AND ENVIRONMENTAL CONSIDERATIONS

For DLE to compete effectively with traditional brine evaporation methods, improvements in economics and sustainability are necessary. This includes enhancing metrics such as carbon emissions and overall environmental impact. As the lithium market evolves and demand continues to rise, the pressure to innovate and adopt more efficient extraction methods will intensify.

CONCLUSION

The landscape of lithium extraction is poised for transformation through direct lithium extraction technologies. By addressing the limitations of conventional brine mining and tapping into underutilized brine resources, DLE could play a critical role in meeting future lithium demand. As the industry navigates challenges and uncertainties, the potential for DLE to reshape lithium mining practices remains significant, making it a focal point for investors and stakeholders in the rapidly evolving energy sector.