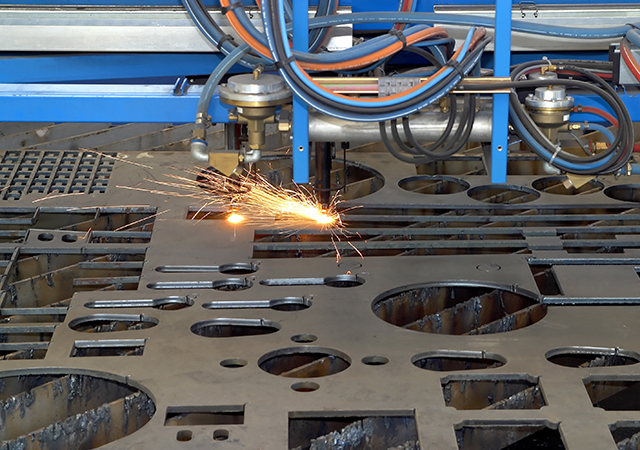

Mirceab iStock Images

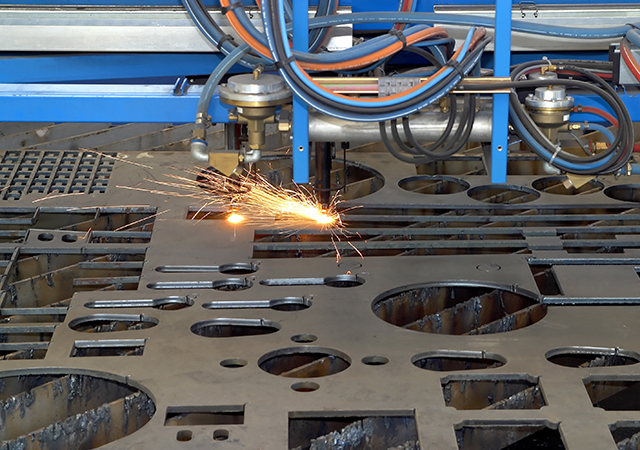

Mirceab iStock Images

As the global push for decarbonisation intensifies, the steel industry finds itself at a critical juncture. Steelmaking's significant contribution to greenhouse gas emissions means that its transition to more sustainable processes will be crucial to driving down global emissions and meeting net-zero targets.

However, the path forward is complex, requiring technological advancements and careful navigation of evolving economic and policy landscapes, according to a report by Wood Mackenzie.

THE CURRENT STEELMAKING LANDSCAPE

The blast furnace-basic oxygen furnace (BF-BOF) process currently dominates the global steel industry, mainly due to its low cost and ability to handle a range of iron ore qualities. However, this process is notoriously difficult to decarbonise, posing a significant challenge as the industry aims to reduce its carbon footprint, stated the report.

In contrast, electric arc furnace (EAF) technology produces far less emissions, leading to a rapid growth in its popularity. EAF-based steelmaking, which utilises scrap material as the primary feedstock, can reduce emissions by 75-80 per cent compared to conventional BF-BOFs. Yet, EAFs do not directly use iron ore inputs, and they are increasingly competing for a limited global pool of scrap, limiting their potential for further expansion.

PATHWAYS TO LOW-CARBON STEELMAKING

To achieve meaningful emissions reductions, the steel industry will likely require a multi-technology approach that goes beyond existing EAF production processes. One promising route is the combination of green hydrogen with direct reduced iron (DRI).

Using green hydrogen instead of natural gas or coal to produce DRI as the metallic feedstock eliminates the sources of carbon from the steelmaking process, making it the route closest to carbon neutrality. As a result, DRI's share in the metallic mix is projected to more than double by 2050, claimed Wood Mackenzie report.

However, the current DRI landscape is predominantly gas-based, with coal-based facilities largely concentrated in India and China. Any shift towards green hydrogen as a feedstock for DRI production is likely to be a gradual evolution, with natural gas serving as a bridge to a green hydrogen future.

Another potential solution is the electric smelting furnace-basic oxygen furnace (ESF-BOF) process. This technology utilises electricity, instead of coal/coke, as fuel like an EAF, but it can accept DRI produced with low and medium-grade iron ores as a feedstock. The ESF-produced liquid hot metal can then be processed into steel in a traditional basic oxygen furnace. ESF-BOF can potentially be rolled out at existing BF-BOF facilities, helping to reduce blast furnace use and cut emissions while minimising capital expenditure and operational complexity.

THE COST CONUNDRUM

The cost competitiveness of different steelmaking processes will remain a crucial factor in the industry's transition. Without rigorous carbon pricing, traditional BF-BOF is likely to remain the lowest-cost route for steel production across most global regions.

DRI-ESF-BOF, on the other hand, could reach near cost parity with traditional DRI-EAF over the long-term, and in some cases, it could even be cheaper, depending on regional dynamics and the fuel feedstock used (natural gas or hydrogen). However, hydrogen-based DRI is currently 30 per cent more expensive than gas-based DRI, and even more so compared to coal-based DRI in India. Significant green incentives and stringent carbon tax policies will be essential for further cost mitigation.

POTENTIAL HUBS FOR DRI-BASED STEEL

According to the report, Experts foresee seven potential hubs for DRI-based steel production by 2050, each with a distinct technological mix and development timeline. The Middle East, China, Australia, and Europe are likely to lead DRI capacity additions, while the US and Brazil will see some traction, albeit with high scrap use dampening DRI demand. India, on the other hand, is expected to shift from coal to gas-based DRI only gradually, limiting its potential contribution to green steel production.

MAKING THE GREEN STEEL REVOLUTION HAPPEN

Decarbonising the global steel industry is a complex challenge that will require technological innovation, policy support (including robust carbon taxation and green incentives), and significant investment. The rollout of green steel will depend on multiple factors, including iron ore quality, hydrogen and natural gas availability, renewable energy sources, the intricacies of carbon pricing, and the legacy of existing steel frameworks.

The path ahead is not without obstacles, including limited DR-grade iron ore supply, hurdles to electrification and hydrogen production scalability, logistics concerns, and the overarching high costs of greening the industry. However, the potential reward is substantial: a cleaner, more sustainable global steel industry that can contribute to a greener future for all.