The Gulf Cooperation Council (GCC) member states have placed significant importance on developing the logistics sector as a catalyst for economic growth. Substantial investments have been earmarked for the establishment of new ports, logistics hubs, railway lines, and transportation initiatives throughout the region.

The GCC region's freight and logistics market size is estimated at $47.59 billion in 2023, and is expected to reach $66.61 billion by 2029, growing at a CAGR of 5.76% during the forecast period (2023-2029), according to Mordor Intelligence.

Rail is the fastest-growing mode of transport in the market. Increased rail freight investments in the region is contributing to the segment's growth, it said.

E-commerce growth has been a driving factor for the segment, which registered a size of $33.2 billion in GCC as of 2022. The market volume is expected to rise to around $63.31 billion by 2027.

Saudi Arabia is the largest country for the GCC logistics market. Following the adoption of the country's new policy, the transport and logistics sector is anticipated to represent 10% of the Saudi Arabian GDP by 2030, up from 6% in 2021.

GCC has committed $121.3 billion to schemes focused on improving land transportation infrastructure, such as road, bridge, and railway projects. This cash injection will benefit Dubai, Saudi Arabia, Qatar, Kuwait, Oman, and Bahrain.

GCC warehousing and distribution logistics

The GCC warehousing and distribution logistics market size is estimated at $14.69 billion in 2023, and is expected to reach $21.13 billion by 2028, growing at a CAGR of 7.54% during the forecast period (2023-2028).

There has been an increase in warehousing demand in GCC countries due to huge investments by the companies for their inventory storage and logistics market-driven by e-commerce. Technology advancement is also supporting market growth.

The GCC's warehousing and distribution logistics market is estimated to witness substantial growth during the forecast period due to the increasing warehousing infrastructure and government and private investments to develop the region into a robust logistics hub with pro-business regulatory policies. The UAE is one of the fastest-growing countries in the GCC region, owing to the rising importance of Dubai in world trade and its strong economic outlook for the forecast period.

Bahrain offers some of the lowest setups and operating costs for a logistics business, with cost savings of 30-40% compared to the rest of the GCC. This has encouraged several companies to invest in the country to set up businesses and access the GCC and the Arab world.

According to industry sources, despite the Covid-19 pandemic-induced economic challenges, the Saudi warehousing sector maintained its winning streak in 2021 as e-commerce and megaprojects boosted demand for larger areas. The need for warehousing is predicted to grow in the next few years due to the growing population and planned big projects in line with Saudi Vision 2030.

Riyadh, Jeddah-King Abdullah Economic City (KAEC), and Dammam-Al Khobar are the main hubs for the Saudi Arabia's logistics and warehousing business, with a combined supply of 72 million sq m.

The interest in time-tested warehouse automation systems that pick, pack, sort, and transport products across the facility are rising. To maximise the benefit of automation, end users are increasingly researching ways to incorporate this automation into warehouse software platforms like warehouse management and warehouse control systems (WCS), said the Mordor Intelligence report.

E-commerce growth driving the market

The GCC e-commerce market is expanding with increasing competition, driven primarily by the UAE and Saudi Arabia. The GCC region has a high spending potential in line with its high per capita income. Additionally, internet penetration and social media penetration are also among the best globally, meaning that the GCC is ready for strong growth in the e-commerce market.

According to industry reports, customers in Saudi Arabia are turning more frequently to their digital devices and are spending more time and money online. About 91% of Saudi customers currently shop online, according to the study. As the opportunity to buy an ever-wider choice of goods and services becomes increasingly fundamental to their everyday life, it is perhaps even more striking that a startling 14% of them say they shop online at least once each day.

Logistics centres

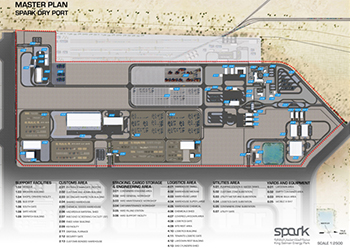

Meanwhile, Saudi Arabia's HRH Prince Mohammed bin Salman bin Abdulaziz, Crown Prince, Prime Minister and Chairman of the Supreme Committee for Transport and Logistics, launched the kingdom's Master Plan for Logistics Centres last month.

It is mainly aimed at developing the infrastructure of the kingdom’s logistical sector as well as greatly enhancing the status of KSA as a leading investment and a global logistical hub, reported SPA.

The Master Plan for Logistics Centers involves the development of 59 centres over a total area of more than 100 million sq m, including 12 in the Riyadh Region, 12 in Makkah Region, 17 in the Eastern Region and 18 distributed across the kingdom, he stated.

A senior official also said Saudi Arabia plans to establish 59 logistics zones and increase the capacity of its ports to more than 40 million containers by 2030.

Speaking at a reception in London, Deputy Minister of Transport and Logistic Services and Acting Chairman of the Transport General Authority, Dr Rumaih Al-Rumaih, said the national strategy for transport and logistics had set clear goals in all aspects of maritime development, pointing out that the kingdom aims by 2030 to be among the top 10 countries in the Logistics Performance (LPI) index.