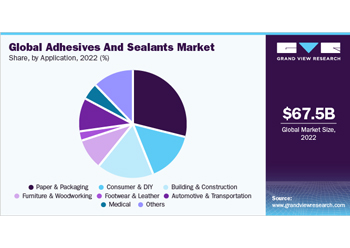

The global adhesives and sealants market size, which was valued at $67.48 billion in 2022, is expected to register a compound annual growth rate (CAGR) of 6% from 2023 to 2030, says a report from Grand View Research.

Changes in material consumption patterns, wherein materials, such as aluminum, metal, and paper, are being replaced by highly durable materials, are anticipated to positively affect the products demand in packaging applications, over the next eight years, it said.

Consistent demand for packaging products from the food & beverage industry is anticipated to remain the key driver for the market in the US. Additionally, the increasing presence of discount retailers in the US and the high potential for grocery retail is likely to push the adhesive demand for packaging products. This, in turn, is likely to benefit the long-term growth of the market. Moreover, the market is driven by demand from industries such as construction, automotive, and packaging. With the growth of these industries, the demand for adhesives and sealants is expected to increase.

The paper & packaging application segment in the US adhesives market is expected to emerge as the fastest-growing application segment at an estimated CAGR of 4.9% from 2023 to 2030. Increasing demand for bio-based products is expected to augment the demand for hot melt technology over the forecast period and contribute to the expansion of the paper & packaging segment, the study said.

Technology Insights

Reactive & others technology dominated the market with a revenue share of 49.2% in 2022. Reactive technology-based products offer several advantages and thus are the key factors behind the growth of the segment. These advantages include high manufacturing speeds owing to short setting time, higher heat resistance, and strong adhesion properties to a wide range of substrates hot-melt segment is anticipated to grow at a lucrative pace from 2022 to 2030.

Within the textiles & fabrics industry, the use of polyester hot melt adhesives started gaining prominence in the last decade. The wider use of the product was observed in the cotton, wool, and fabrics sub-sector over the last few years. The reason being the product greatly improves the anti-pilling performance of cotton-woven fabrics while enhancing the elastic recovery rate of the fabric, the report said.

The use of hot melt adhesive products in the dashboard of automotive vehicles increasingly becoming popular across the globe. These products find applications in the dashboard wherein it offers reduced vibrations coupled with greater insulation from the sound. The increased focus to offer soundproof ride is likely to push the product’s penetration in the automotive industry during the forecast period, it said.

Product Insights

Acrylic product segment dominated the market with a revenue share of 36.5% in 2022. The segment is projected to grow on the account of rising construction activities and investments in infrastructure space. The construction of chemical/industrial process plants, stadiums, bridges, museums, concert halls, research facilities, and medical buildings is projected to benefit the expansion of the segment.

Polyurethane adhesive products exhibit superior properties such as fast curing, good abrasion & chemical resistance, and excellent bond strength on various substrates such as metal, plastic, rubber, wood, and glass. These products are generally based on reactive technology and contain polymers that have urethane linkages. These materials provide solidity, low viscosity, and less cure time to the adhesive.

Epoxy-based products adhere to a wide variety of materials and their superior properties are dependent on the nature of cross-linking polymers. They provide high resistance to chemicals and environments and high-temperature resistance along with high-strength bonding on a variety of substrates. These adhesives are generally based on reactive technology.

Application Insights

Paper & packaging segment dominated the market with a revenue share of 29.3% in 2022. Flexible packaging is projected to new avenue for market players over the coming years. The sudden rise in healthcare spending positively affected the demand for packaging products on account of the demand for PPE kits, surgical masks, and other healthcare products.

Building & construction segment is projected to provide numerous opportunities in the industry. This segment in the adhesives & sealants industry is witnessing rapid technological & architectural innovation. Airports, mining facilities, transportation routes & even residential projects are undergoing an immense transformation in order to comply with transitioning standards & specifications.

Demand for products in the assembly of electrical & electronics components is projected to benefit the global market. China is among the leading countries in the production of various electrical and electronic components at the global level. Investments in emerging technologies such as 5G and IoT are projected to boost the Chinese electrical & electronics industry during the forecast period.

Regional Insights

Asia Pacific region dominated the market with a revenue share of 41.2% in 2022. The Covid-19 pandemic created a sizable impact on various industries such as textile & garments, construction, and automotive in 2020, wherein export trade was also largely impacted. For instance, as per the government data, the textile trade between China and India observed a year-on-year decline of 12.4% in the first 2 months of 2020 from the previous year. The market has shown a positive recovery since the third quarter of 2020 and gained momentum during 2021.

GCC is one of the key growth engines for the Middle East & Africa. Growing construction activities in the GCC region are likely to fuel the demand for adhesives & sealants over the forecast period. In the recent past, the housing sector in GCC countries did not perform well. This was mainly due to the decline in oil prices and the economic slowdown. However, over the coming years, the construction industry is projected to perform well owing to investments in residential construction, energy, and transport infrastructure, said the report.