WorldACD air cargo tonnages graph

WorldACD air cargo tonnages graph

Air cargo’s strong seasonal fourth quarter (Q4) appears to have peaked, with tonnages and rates dropping slightly in the second full week of December, including from Asia Pacific origins. This is according to the latest figures and analysis by WorldACD Market Data.

Following several weeks of consecutive week-on-week (WoW) rises, average spot rates from Asia-Pacific origins dropped by around -4% in week 50 (December 9 to 15), compared with the previous week, to $4.57 per kilo. That fall in prices from Asia-Pacific origins was offset by a +6% rise from North America and a +5% increase from Middle East & South Asia (MESA) origins, together leading to a worldwide -1% WoW dip in spot rates overall. Nevertheless, compared with last year, average global spot rates in week 50 this year were +16% higher, at $3.20 per kilo, driven by a +60% year-on-year (YoY) rise from MESA, a +14% increase from Asia Pacific, +13% rise from Europe, and +8% rebound from North America origins, plus small increases from Africa and Central & South America (CSA).

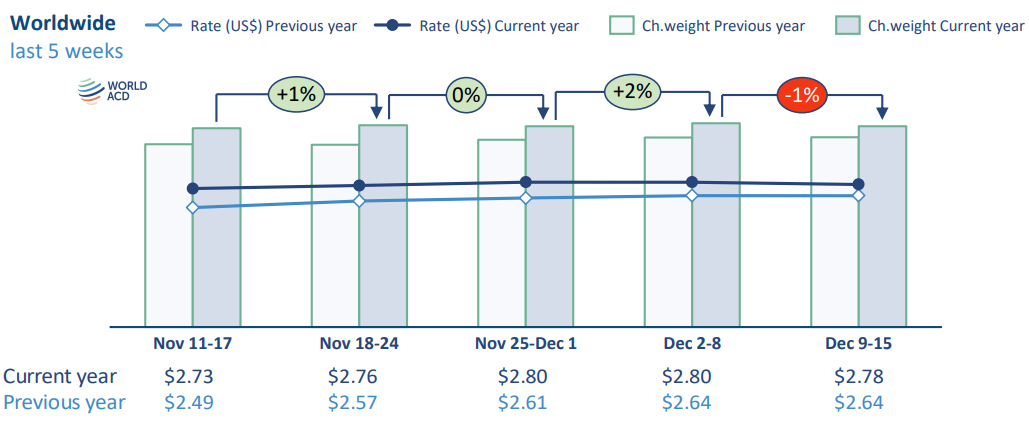

Average worldwide contract rates also recorded a small (-1%) WoW decrease, to $2.61 per kilo, generating a similar -1% drop in overall worldwide air cargo prices to $2.78 per kilo, based on a full-market average of spot rates and contract rates – but around +6% higher, YoY. WorldACD’s figures are now based on more than 500,000 weekly transactions, thanks to the addition this month of four new air cargo airline participants to the WorldACD database.

Demand decrease

With worldwide air cargo capacity stable, WoW, in week 50, as a -1% drop in worldwide freighter capacity was balanced out by a +1% increase in passenger belly capacity, the changes in spot prices broadly reflected variations in demand. Overall worldwide tonnages fell by -1%, WoW, with a -2% drop in tonnages from Asia-Pacific origins and a -7% fall from MESA origins offset by a +4% tonnage increase from Africa and +2% rise from CSA, boosted by rising seasonal shipments of perishables northbound from those southern hemisphere markets – for example, from Egypt to Europe.

Asia Pacific individual markets

Examining the WoW performance of various key Asia Pacific outbound markets in week 50, individual spot rates from Asia Pacific to the USA, and from China to the USA specifically, edged up slightly higher, WoW, to $6.94 and $6.98 per kilo, respectively. And compared with last year, Asia Pacific to USA spot rates in week 50 are slightly (+4%) higher, YoY, although China to USA rates are down by -7%, YoY. Meanwhile, chargeable weight in week 50 from Asia Pacific and China to the USA was down, WoW, by -5% and -4%, respectively. But compared with last year, tonnages from Asia Pacific to the USA are +5% higher, while from China to the USA only slightly higher (+1%).

From Asia Pacific to Europe, all of the big origin markets recorded significant WoW drops in tonnages in week 50, including WoW falls of -10% from Vietnam, -9% from Thailand, -8% from Hong Kong, -6% drops from both China and Japan, and a -4% WoW drop from South Korea. But compared with last year, volumes from most of those markets are significantly elevated still in week 50 of this year, including a +26% YoY increase from Japan, +23% from China, +19% from Vietnam, and +15% from Hong Kong.

And the picture is similar on the pricing side, including WoW declines in week 50 to Europe from Taiwan (-11%), Japan (-7%), and China (-5%), although spot prices from Hong Kong to Europe remain stable at close to their 2024 high of $6.21 per kilo. But YoY, spot prices from all those major origin markets to Europe are significantly higher in this year’s week 50, including a +63% YoY rise from Thailand, +40% increase from Taiwan, +28% increase from Vietnam, +25% from Japan, +16% from South Korea, +13% From China, and +7% from Hong Kong.--TradeArabia News Service