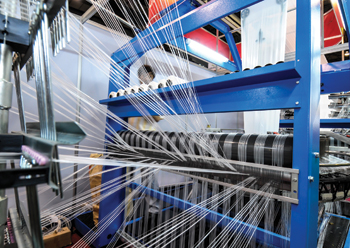

A textile weaving machine

A textile weaving machine

In 2021, global shipments of spinning, texturing, weaving, knitting, and finishing machines increased sharply compared to 2020. The deliveries of new short-staple spindles, open-end rotors, and long-staple spindles rose by +110 per cent, +65 per cent and +44 per cent respectively, according to the International Textile Manufacturers Federation (ITMF).

The number of shipped draw-texturing spindles surged by +177 per cent and deliveries of shuttle-less looms grew by +32 per cent. Shipments of large circular machines improved by +30 per cent and shipped flat knitting machines registered a 109 per cent growth. The sum of all deliveries in the finishing segment also rose by +52 per cent on an average.

These are the main results of the 44th annual International Textile Machinery Shipment Statistics (ITMSS) just released by ITMF. The report covers six segments of textile machinery, namely spinning, draw-texturing, weaving, large circular knitting, flat knitting, and finishing.

The 2021 survey has been compiled with more than 200 textile machinery manufacturers, ITMF said.

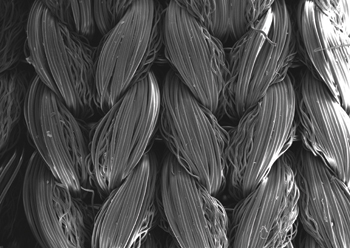

SPINNING MACHINERY

The total number of shipped short-staple spindles increased by about 4 million units in 2021 to a level of 7.61 million. Most of the new short-staple spindles (90 per cent) were shipped to Asia and Oceania, where delivery increased by +115 per cent. While levels stayed relatively small, Europe saw shipments increasing by +41 per cent (mainly in Turkey). The six largest investors in the short-staple segment were China, India, Pakistan, Turkey, Uzbekistan, and Bangladesh, ITMF said in a press release.

About 695,000 open-end rotors were shipped worldwide in 2021. This represents 273,000 additional units compared to 2020. 83 per cent of global shipments went to Asia and Oceania where deliveries increased by +65 per cent to 580,000 rotors. China, Turkey, and Pakistan were the world’s 3 largest investors in open-end rotors and saw investments surging by +56 per cent, +47 per cent and +146 per cent, respectively. Only deliveries to Uzbekistan, the 7th largest investor in 2021, decreased compared to 2020 (-14 per cent to 12,600 units).

Global shipments of long-staple (wool) spindles increased from about 22,000 in 2020 to nearly 31,600 in 2021 (+44 per cent). This effect was mainly driven by a rise in deliveries to Asia & Oceania with an increase in investment of +70 per cent. 68 per cent of total deliveries were shipped to Iran, Italy, and Turkey.

TEXTURING MACHINERY

Global shipments of single heater draw-texturing spindles (mainly used for polyamide filaments) increased by +365 per cent from nearly 16,000 units in 2020 to 75,000 in 2021. With a share of 94 per cent, Asia and Oceania was the strongest destination for single heater draw-texturing spindles. China, Chinese Taipei, and Turkey were the main investors in this segment with a share of 90 per cent, 2.3 per cent, and 1.5 per cent of global deliveries, respectively.

In the category of double heater draw-texturing spindles (mainly used for polyester filaments) global shipments increased by +167 per cent to a level of 870,000 spindles. Asia’s share of worldwide shipments increased to 95 per cent. Thereby, China remained the largest investor accounting for 92 per cent of global shipments.

WEAVING MACHINERY

In 2021, worldwide shipments of shuttle-less looms increased by +32 per cent to 148,000 units. Shipments in the categories “air-jet”, “rapier and projectile”, and “water-jet” rose by +56 per cent to nearly 45,776 units, by +24 per cent to 26,897, and by +23 per cent to 75,797 units, respectively. The main destination for shuttleless looms in 2021 was Asia and Oceania with 95 per cent of all worldwide deliveries. 94 per cent, 84 per cent, 98 per cent of global air-jet, rapier/projectile, and water-jet looms were shipped to that region. The main investor was China in all three sub-categories..

KNITTING MACHINERY

Global shipments of large circular knitting machines grew by +29 per cent to 39,129 units in 2021. The region Asia & Oceania was the world’s leading investor in this category with 83 per cent of worldwide shipments. With 64 per cent of all deliveries (i.e., 21,833 units), China was the favoured destination. Turkey and India ranked second and third with 3,500 and 3,171 units, respectively. In 2021, the segment of electronic flat knitting machines increased by +109 per cent to around 95,000 machines. Asia & Oceania gained a share of 91 per cent of world shipments. China remained the world’s largest investor with a 76 per cent share of total shipments and a +290 per cent increase in investments. Shipments to the country rose from about 17,000 units in 2020 to 676,000 units in 2021.

FINISHING MACHINERY

In the “fabrics continuous” segment, shipments of relax dryers / tumblers grew by +183 per cent. All other subsegments rose by 33-88 per cent except dyeing lines which shrank (-16 per cent for CPB and -85 per cent for hotflue). Since 2019, ITMF estimates the number of shipped tenters non-reported by the survey participants to inform on the global market size for that category. The global shipments of tenters has increased by +78 per cent in 2021 to a total of 2,750 units.

In the “fabrics discontinuous” segment, the number of jigger dyeing / beam dyeing shipped rose by +105 per cent to 1,081units. Deliveries in the categories “air jet dyeing” and “overflow dyeing” increased by +24 per cent in 2021 to 1,232 units and 1,647 units, respectively.